Financial Well-Being at Work

A holistic approach to employee financial wellness.

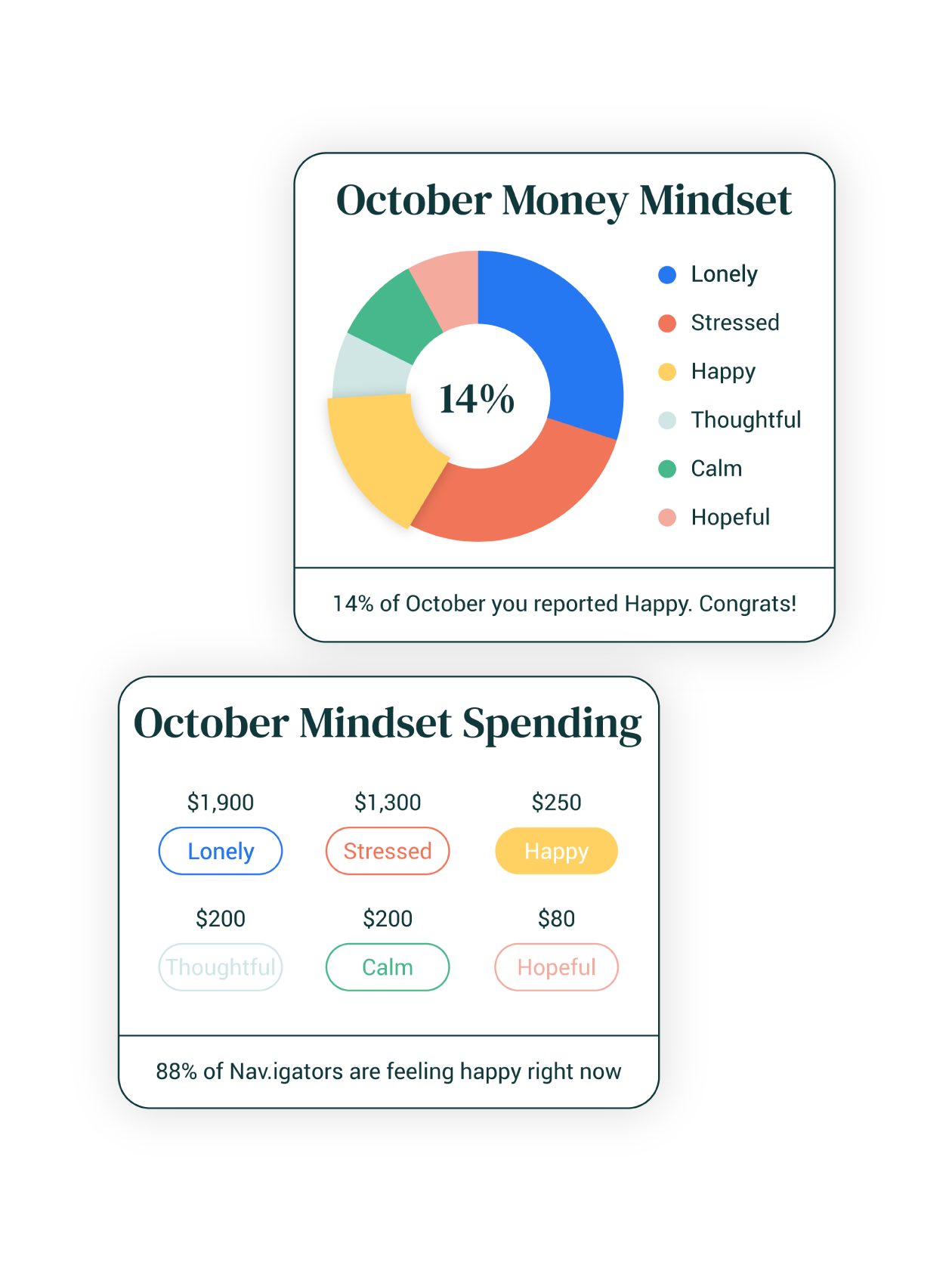

A new approach to money and mindset

Financial stress, meet our FinWell Score.

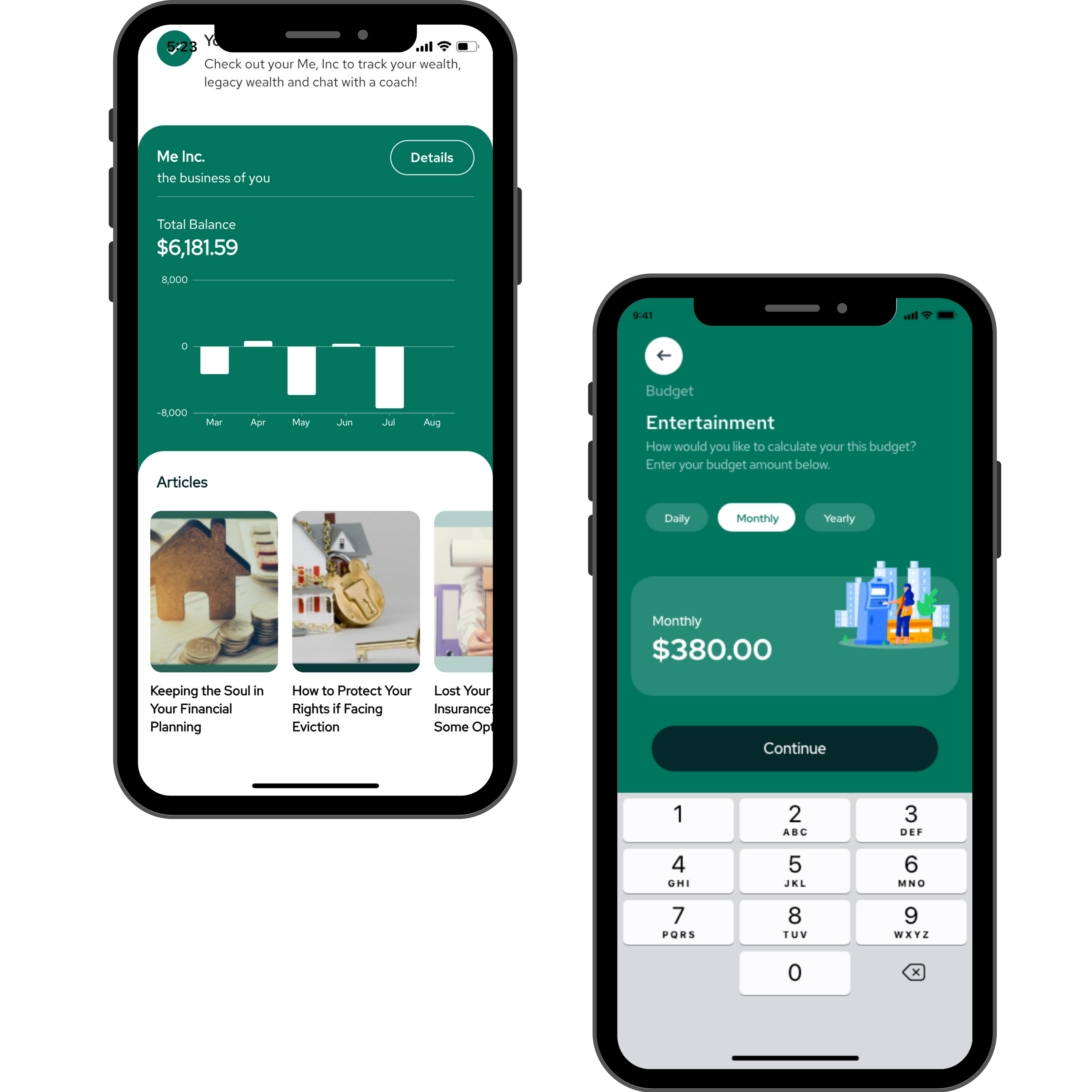

Nav.it's the first money management and mobile banking app that measures daily financial well-being to foster financial resilience and build healthy money habits. Our FinWell Score tracks how you spend and save on both the good days and the, well, not so great. Use it to evaluate financial habits today so you can make better money decisions tomorrow.

Stress impacts spending. Help your employees monitor improve both.

Track behavioral wellness while improving financial habits.

Nav.it is a financial well-being app that reduces employee stress while improving financial habits.

Our Features

For Your Team of Money Movers

-1.png)

All-In-One

Finally, a financial well-being app that allows your employees to track every aspect of their financial roadmap. From daily budgeting and debt management to goal setting for life events, we connect every financial account to help your team members meet their goals.

Savings & Repayment

We're not just a management tool. Our suite of banking services help employees save more, spend less, and consolidate debt more effectively with automated savings, aggregate account management, and lower interest loans.

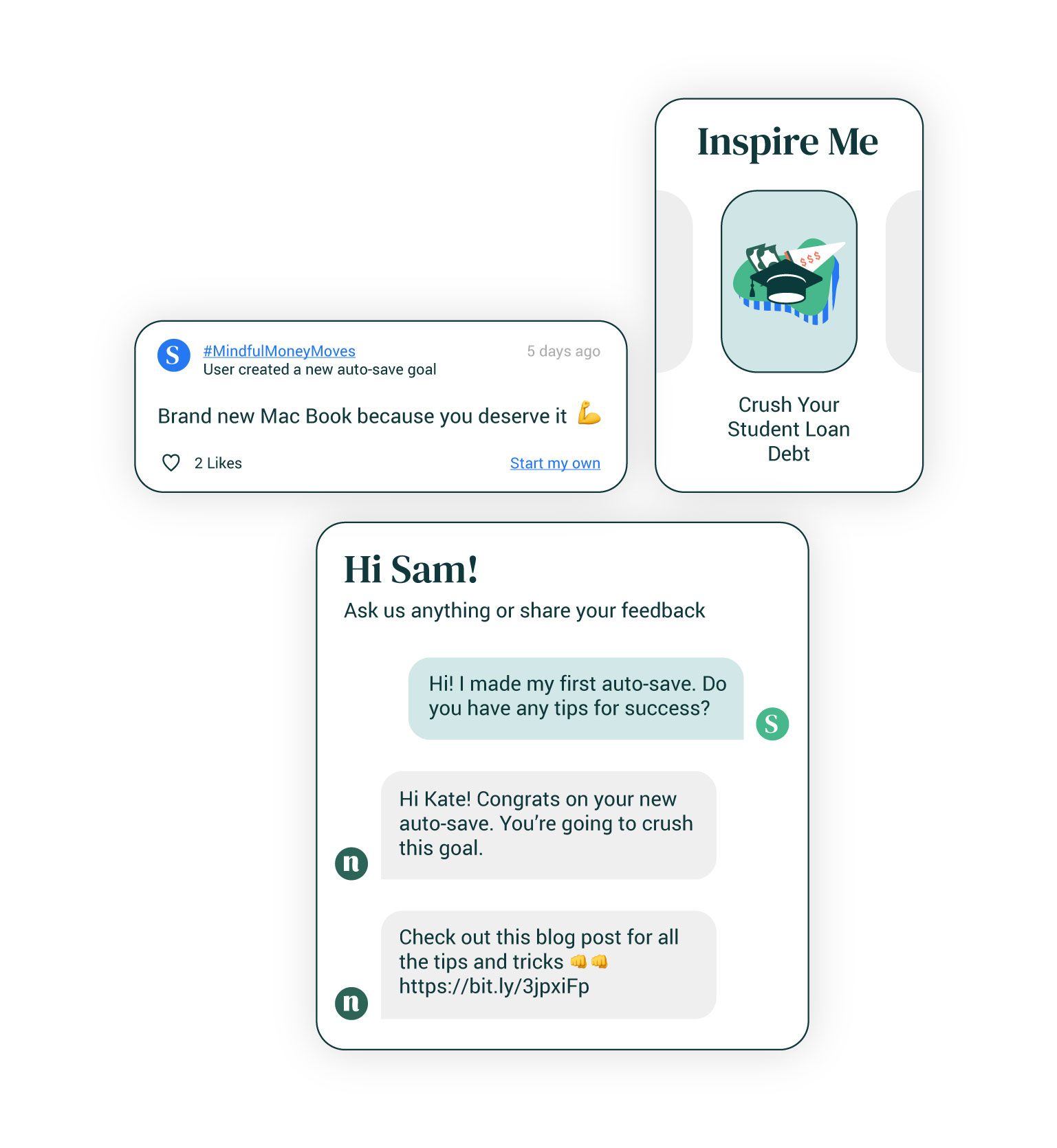

Dedicated Support

From in-app coaching to a dedicated account team, we'll help you build the most comprehensive wellness program to address your employees' evolving needs.

Safe & Confidential

We're leading the industry in transparency. Your data is yours. Everything is de-identified and aggregated to ensure your colleagues stay protected.

Our Service

An Empowered Benefit

Empowering Your Workforce

American businesses are losing $500 billion per year due to employees’ personal financial stress.

Meanwhile, 42% of the financially stressed employees are 11x more likely to suffer from sleeplessness, 10x more likely to not finish daily tasks at work, 9x more likely to have poor coworker relationships, and 2x more likely to be on the job hunt.

Nav.it's FinWell Score and predictive analytics helps track financial behavior, improve habits and notify employers when financial stress is overwhelming their population - no matter age or income.

Preparing For Every Life Stage

28% of employees have some form of 401(k) loan outstanding and those who do are less likely to contribute thereafter.

With cost of living, student debt, and consumer debt increasing, a majority of Americans struggle to meet between-paycheck expenses, even among those making at or over $100,000.

Nav.it coaching, in-app education, debt repayment tools, and lower interest loans help employees improve their creditworthiness, pay down debt faster, and plan for short and long-term goals.

Innovating Financial Well-being

Employees who report high stress are $413 more costly per year compared to their less-stressed counterparts.

While wellness programs often include gym memberships, nutritional support and 401(k) matching, they often fail to address the top stressor of more than half of America's workforce, financial stress.

Quarterly insights reports and a 24/7 Dashboard of de-identified financial and cognitive data helps you monitor employee stress, improve engagement, and benefit from a healthier, happier workforce.

Supporting Financial Security

Half of the workforce says emergency savings is a major concern. Meanwhile, 72% worry about their money while at work.

Worse still, without financial security, employees aren't able to seek out healthcare when they need it most, especially as care costs continue to surpass wages.

Nav.it Auto Saves provide the automated nudge needed to address needs before they become emergencies, building peace of mind and avoiding a cycle of pay-day advances.

An inclusive approach

Making Money More Affordable

It's a fact. Money is cheaper for those of us with higher credit scores and for those who know how to navigate the financial system. That's why Nav.it's daily well-being score is used by financial institutions to de-risk our Navigators. When we're considered less risky, we're able to negotiate better rates, pay off debt faster and build assets. That's how you build wealth, inclusively.

De-risk, consolidate, become "well"-thy.

The Path To a Resilient Money Mindset

De-risk

Our proprietary FinWell Score measures financial literacy, mood, behavior, efficacy, plus all the other stats you'd expect from a money management tool capable of financially and emotionally empowering your teams.

Consolidate

High-interest credit card debt is a devastating reality of our financial system. We help employees consolidate debt by moving them into low-cost banking solutions, directly in the app.

Grow

Financial management is all about improving money management (and knowing where to begin). Once they've nailed the basics, we'll help employees optimize their financial health.

Mitigating financial stress will bring enjoyment back to your team's work.

Support your team's money mindset with an empowered benefit plan.