Nav.it on Campus

The Data

A Financially Resilient & Empowered Campus

1 in 2 dropouts leave for financial reasons*

32% of students with financial stress neglect studies*

*https://cssl.osu.edu/posts/documents/nsfws-key-findings-report.pdfAdding one trained counselor to the staff can cost $40k/year*

*Glassdoor

Only 10-15% of students seek services*

*https://www.higheredtoday.org/2018/12/17/rise-mental-health-college-campuses-protecting-emotional-health-nations-college-students/

Track behavioral health while improving the financial habits of students on campus.

Nav.it is a financial well-being app that helps universities and campuses reduce counseling costs, increase retention rates, and relieve the financial stress of its students while improving their financial habits.

A new approach to money and mindset

Increasing financial resilience one student at a time.

Financial Well-being on Campus

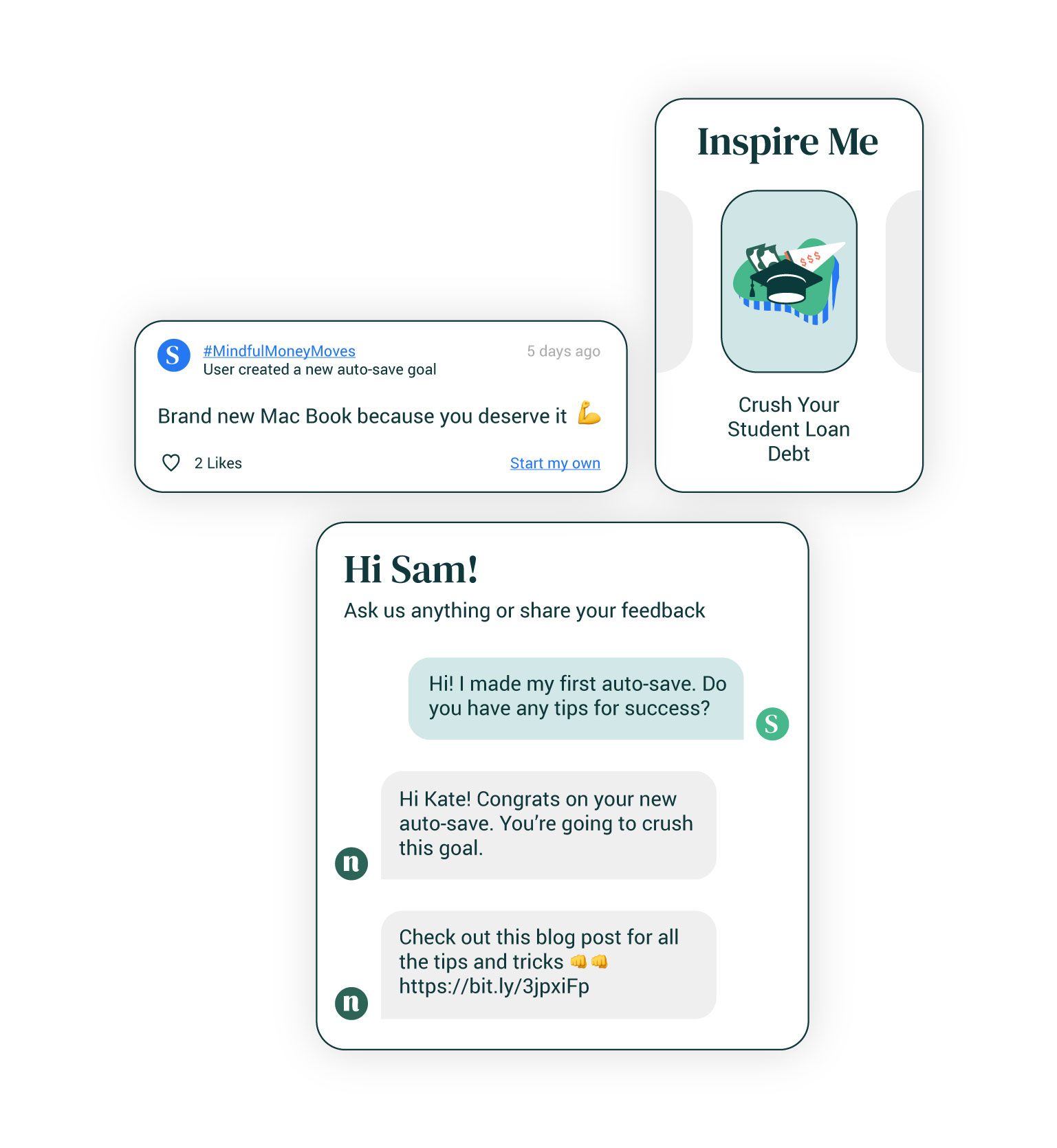

For college students, managing their money for the first time can be challenging. Luckily, Nav.it is here to help. Through Money Mindfulness check-ins, awesome Community features, and budgeting tools they’ll actually use, Nav.it is helping students stress less about money (so they can get back to studying).

To find out more about why universities need to prioritize financial fitness and stress on their campuses, and what students want to see from their administrations, check out our guide on campus financial well-being by completing the form.

.gif)

Our Features

For Your Student Body of Money Movers

-1.png)

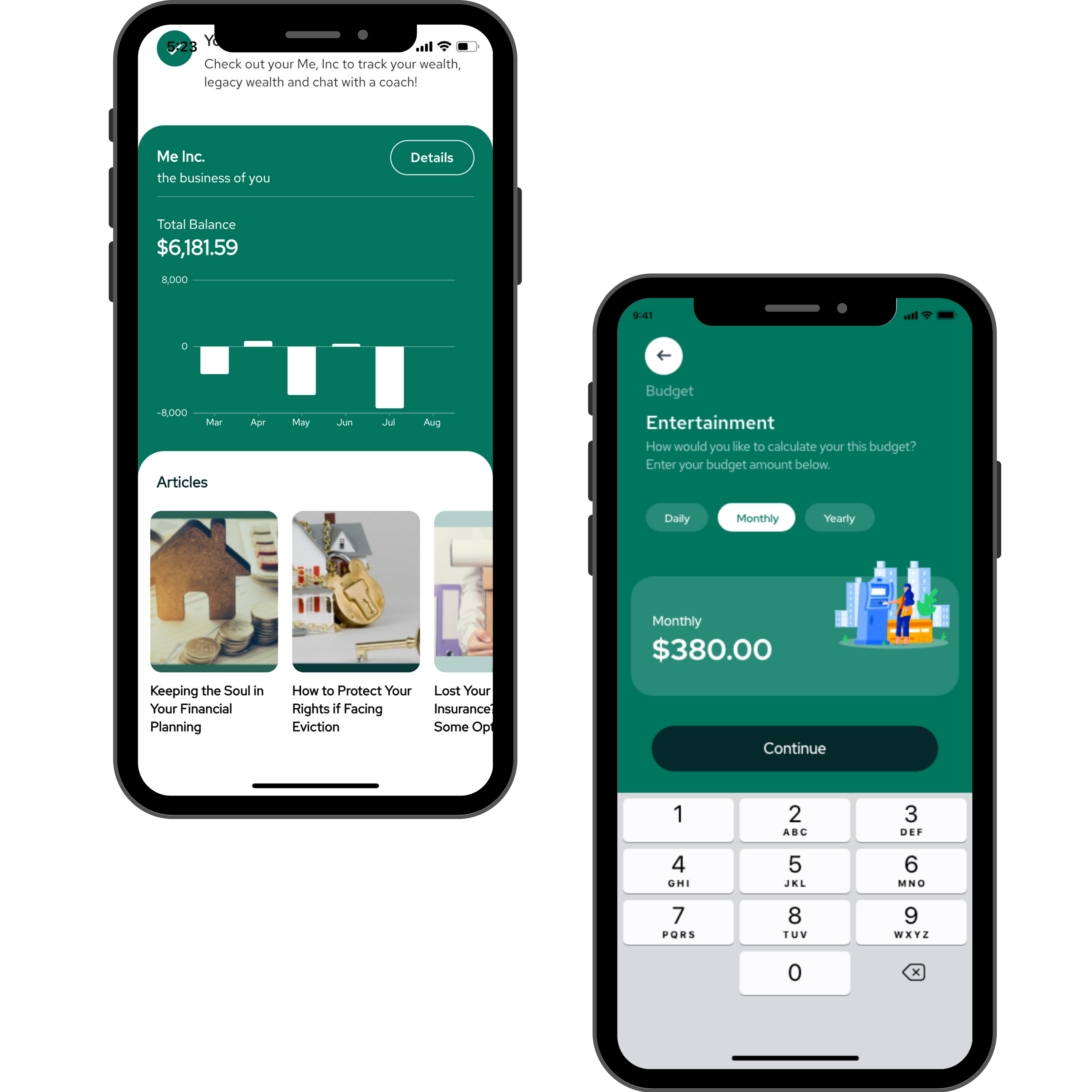

All-In-One

Finally, a financial well-being app that allows your students to track every aspect of their financial roadmap. From daily budgeting and debt management to goal setting for life events, we can connect to every financial account.

Savings & Repayment

We're not just a management tool, our suite of banking services help employees save more, spend less, and consolidate debt more effectively with automated savings, aggregate account management, and lower interest loans.

Dedicated Support

From in-app coaching for students to a dedicated account team, we'll help you build the most comprehensive wellness program to address your campus's evolving needs.

Safe & Confidential

We're leading the industry in transparency. Your data is yours. Everything's de-identified and aggregated to ensure your colleagues stay protected.

An inclusive approach

Making Money More Affordable

It's a fact. Money is cheaper for those of us with higher credit scores and a strong know-how to navigate the financial system. That's why Nav.it's daily well-being score is used by financial institutions to de-risk our Navigators. When we're less risky, we're able to negotiate better rates, pay off debt faster, and build assets. That's how you build wealth, inclusively.

De-risk

Our proprietary FinWell Score measures financial literacy, mood, behavior, efficacy, plus all the other stats you'd expect from a money management tool capable of empowering your teams.

Consolidate

High-interest credit card debt is a crippling reality of our financial system. We help employees consolidate debt by moving them into low cost banking solutions, directly in the app.

Grow

Financial management is all about improving money management (and knowing where to begin). Once they've nailed the basics, we'll help employees optimize their financial health.